vision

Excellence in Thromde Financial management through enhanced professionalism and to make a sustainable and self-reliant Thromde.

mission

Ensure prudent use of public resources through judicious expenditure management and enhancing revenue base.

Objective

Increased revenue and reduced expenses for better services.

The financial division

The Finance Division comprises three sections:

Key Role of Finance Division

- Financial Operator: Ensure efficient and effective utilization of government resources by being an intermediary between the public and private domain. To apply due diligence, care, and judgment within the broad guidelines of the Finance Manual, Procurement Manual, Civil Service rules, tax rules, and other general guidelines, rules, and regulations involving financial applications.

- Financial Custodian: To ensure and maintain accurate records and reporting of financial transactions, and reconciliation of accounts in compliance with relevant rules and regulations.

- Financial Strategist:

- Responsible for providing important information and insights that help the agency make informed decisions about its finances and operations.

- Assist in developing financial plans and strategies.

- Assist in monitoring and reporting on the agency’s financial performance.

The Thromde Finance Policy is intended to support and assist the Thromdes to establish sound Thromde financial management practices, strive towards financial sustainability and self-reliance keeping within the principles of decentralization, economy, equity, efficiency, effectiveness, transparency, and accountability.

Phuentsholing Thromde’s financial RESOURCES are in two broad forms:

- Government Grants: Thromdes receives adequate financial resources from the Government in the form of annual grants until such time the Thromdes are able to sustain on their own resources. The grants shall be in the form of current and capital grants: currently financing the education, census, health, and ICT’s recurrent expenses and all the developmental activities.

- Revenue: The revenue shall comprise taxes, levies fees, charges, duties, tolls, etc. All the recurrent expenses are to be met from the internal revenue Thromde collects.

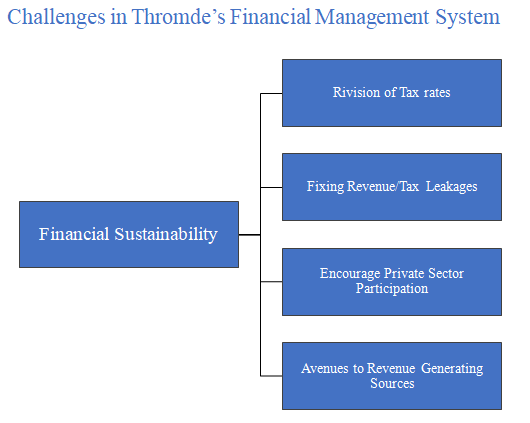

Thromdes are to act as Pseudo-corporations where all services are to be charged nominal fees. However, the services provided should be efficient and effective (LG Act). With the ever-increasing costs due to the increased services, Thromde must strive for strategies to increase revenue and reduce expenses.

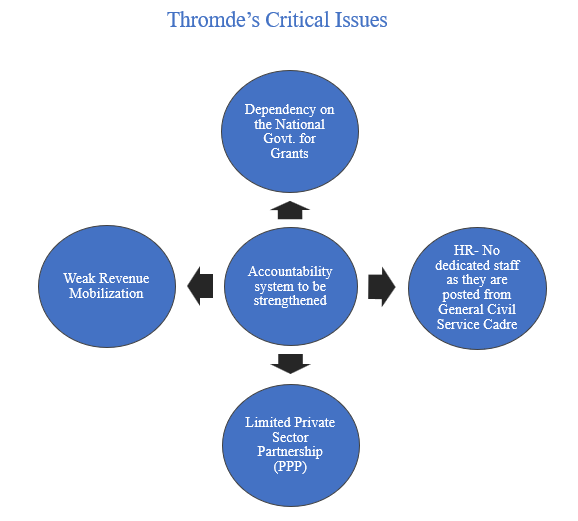

Currently, Thromdes is faced with the chronic critical issues. If Thromdes desires to achieve financial sustainability and self-reliance, these have to be tackled.

STAFF

Meet the dedicated staffs and officials of Phuentsholing Thromde, working tirelessly to shape our Thromde’s future.

Kuenzang Nidup

Senior Accountant

Ugyen Thinley

Accounts Assistant

Pampha Sunwar

Accounts Assistant

Rigyel

Asst. Procurement Officer

Deki

Sr. Storekeeper